Understanding the Revenue Recognition Process

Revenue recognition stands at the core of any business entity’s accounting and financial reporting function. This process largely impacts a company’s financial performance, Thus, investors, regulators, and other stakeholders closely scrutinize it. Today, we will delve into what revenue recognition means, the various recognition models companies adopt, and how to address the problems faced during revenue recognition.

What is the meaning of revenue recognition?

Revenue recognition is the accounting principle that states when revenue should be recognized in the financial statements. It refers to the process of recognizing income when it is earned and measurable, regardless of when payment is received. This helps companies report their financial performance accurately and fairly.

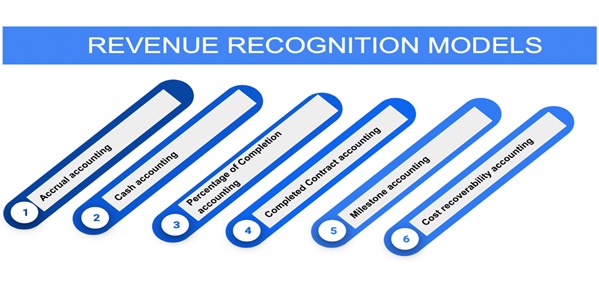

What are the major types of revenue recognition models?

The primary revenue recognition models that most business organizations adopt include:

- Accrual accounting: This revenue recognition model accounts for revenue when earned, regardless of when payment is received.

- Cash accounting: Under cash accounting, companies recognize revenue when payment is received.

- Percentage of completion method: With this model, recognition of earnings takes place as work is performed, based on the percentage of the contract completed.

- Completed contract method: It considers revenue only after all work is completed, and the contract is fulfilled.

- Milestone accounting: Milestone accounting takes revenue under consideration upon completion of specific milestones in a contract.

- Cost recoverability accounting: This method states that revenue cannot be recognized until it is reasonably certain that the company will be able to collect payment for the goods or services provided.

What problems do businesses face while implementing the revenue recognition principle?

Businesses face several challenges while implementing the revenue recognition principle, including:

- Complex contracts: Complex contracts with multiple deliverables or performance obligations can make it difficult to determine when revenue should be recognized.

- Unclear revenue-generating activities: A lack of clarity on revenue-generating activities can lead to improper recognition of revenue.

- Timing issues: Determining the exact time to recognize revenue can be challenging, especially when a transaction spans multiple reporting periods.

- Issues of high unpredictability: There are large uncertainties surrounding the collectability of amounts due, the timing of cash inflows, or the satisfaction of performance obligations.

To resolve these problems, companies can undertake the following steps:

- Implement clear policies and procedures for revenue recognition.

- Conduct regular training sessions to ensure all staff is aware of the revenue recognition principle and how to apply it correctly.

- Use technology, such as revenue management software, to automate the revenue recognition process and ensure consistency.

- When faced with complex revenue recognition decisions, you must seek guidance and hire outsourced accounting services from professionals, such as CPAs and CAs.

- Regularly review and update policies and procedures to ensure they remain effective and consistent with changes in accounting standards and business operations.

What considerations do organizations from different industries follow during the revenue recognition process?

The application of the revenue recognition principle is by and large similar for most forms of business sectors. However, there are peculiarities that critical niches like technology, oil & gas, and healthcare need to consider. Some of the aspects comprise:

Technology ventures

Technology businesses often have complex revenue models, including software licenses, subscriptions, and maintenance and support contracts. They should evaluate the effect of timing and delivery of their performance obligations, the transfer of control to the customer, and the impact of service warranties or renewals on revenue recognition.

Oil & gas companies

During the revenue recognition phase, oil & gas companies must assess the commodity price uncertainty, contractual conditions, capital expenditure, effect of extractive activities, and regulatory compliances. Adequate financial reporting requires a thorough evaluation of these factors to determine the appropriate timing and amount of revenue recognition.

Healthcare organizations

Healthcare businesses must accurately bill and collect payments from patients, insurance companies, and government programs. They also need to understand and comply with reimbursement methodologies and applicable regulations. In addition, healthcare businesses must accurately account for revenue from clinical trials and research activities, including the recognition of grants and funding.

What is the relevance of IFRS 15 and ASC 606 for revenue recognition?

Both IFRS 15 and ASC 606 are international financial reporting standards that provide guidance on revenue recognition for companies operating globally. These standards are especially important for entities adhering to US GAAP for their accounting needs. These two standards require business entities to recognize revenue when control of a good or service has been transferred to a customer and when it is probable that the economic benefits associated with the transaction will flow to the entity. They offer a comprehensive and consistent approach to revenue recognition that applies to all types of contracts with customers, regardless of the industry.

You can better manage intricate matters like revenue recognition with the help of outsourced accounting services. Streamline your accounting and finance processes with the experienced team at Eximius Ventures! Schedule a call today!