Table of Contents

ToggleOutsourcing for Growth: Finance Outsourcing Services

In today’s competitive business environment, companies need to find ways to improve efficiency and focus on growth. Utilizing finance outsourcing services is one strategy businesses use to streamline operations and reduce costs. These services provide specialized expertise, enabling companies to make informed financial decisions.

Outsourcing financial tasks allows businesses to access experienced professionals without hiring full-time staff. This approach saves time, money, and resources. It ensures companies receive accurate and timely finance outsourcing services that support effective decision-making.

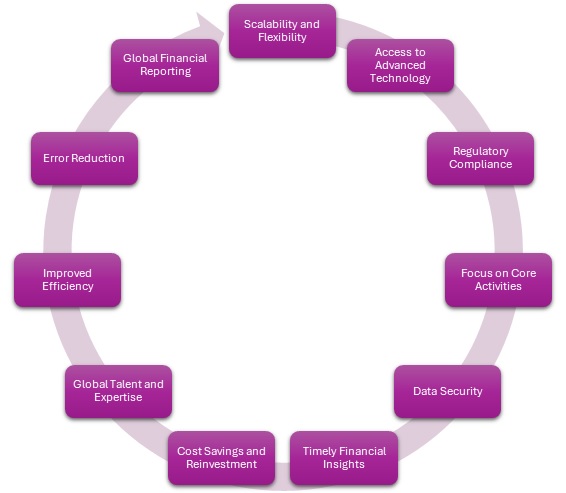

Advantages of

Finance Outsourcing Services

Scalability and Flexibility of Finance Outsourcing Services

Scalability and Flexibility of Finance Outsourcing Services

- Companies can adjust services as needs evolve.

- Businesses pay only for the services they require.

- Access to Advanced Technology

- Providers use cutting-edge financial software for high quality results.

- Enhances efficiency and minimizes reporting errors.

- Regulatory Compliance

- Ensures adherence to legal and industry standards.

- Providers stay updated on regulatory changes, reducing compliance risks.

- Focus on Core Activities

- Frees up time from tasks like payroll and bookkeeping finance outsourcing services.

- Allows companies to concentrate on innovation and growth strategies.

- Data Security

- Reputable providers implement robust measures to safeguard financial information.

- Builds confidence in data safety.

- Timely Financial Insights

- Delivers accurate, up-to-date reports.

- Supports decision-making by identifying opportunities and addressing challenges.

- Cost Savings and Reinvestment

- Saves money that can be reinvested in areas like research, development, and marketing.

- Supports long-term growth and sustainability.

- Global Talent and Expertise

- Access to a diverse pool of industry experts.

- Provides customized solutions tailored to specific business needs

- Improved Efficiency

- Delegates routine tasks to experts.

- Frees up internal teams for strategic projects.

- Boosts productivity and reduces operational bottlenecks.

- Error Reduction

- Minimizes financial management errors through standardized processes.

- Ensures consistency and accuracy in operations.

- Builds trust with investors and stakeholders.

- Global Financial Reporting

- Addresses challenges in managing multi-country operations.

- Standardizes processes across borders.

- Ensures compliance with international accounting practices.

Small and medium enterprises benefit greatly from outsourcing. They gain access to professional services without the expense of building in-house teams. This support helps them compete with larger businesses on an equal footing.

Startups also find outsourcing a valuable tool for managing growth. With limited resources, they can use finance outsourcing to build strong foundations.

Finance Outsourcing Services helps them scale operations efficiently and effectively.

Partnerships with outsourcing providers often lead to innovation. Providers bring fresh perspectives and ideas that improve processes. Finance Outsourcing Services collaboration can help businesses discover new ways to enhance performance.

The cost-effectiveness of outsourcing makes it an attractive option for companies of all sizes. Businesses save on overhead costs while gaining access to high-quality services. This balance supports growth without straining budgets.

In conclusion, leveraging finance outsourcing services can transform how businesses operate and grow. By outsourcing, companies gain expertise, save resources, and improve decision-making. This strategy is a pathway to long-term success in a competitive market.