Overview

In today’s competitive business landscape, organizations face increasing pressure to optimize their Order-to-Cash (O2C) process for enhanced cash flow management, reduced operational costs, and improved efficiency. Outsourcing Accounts Receivable (AR) and O2C processes enables businesses to streamline revenue cycle management while focusing on core business functions.

Industry Insights

- 79% of companies cite improving working capital as a key driver for optimizing their O2C process (PwC Global Working Capital Report).

- 56% of organizations struggle with late payments, leading to cash flow challenges (Atradius Payment Practices Barometer).

- Outsourcing accounts receivable processes can reduce Days Sales Outstanding (DSO) by up to 30%, enhancing financial liquidity (IOFM Research).

Global Trends in O2C Outsourcing

- Increasing Reliance on Third-Party O2C Providers – Over 70% of CFOs consider outsourcing finance and accounting processes to improve cost efficiency and cash flow management (Deloitte Finance Outsourcing Report). Businesses are shifting from in-house AR teams to outsourced O2C providers for scalability, risk mitigation, and reduced overhead costs.

Cost Optimization & Resilience in Financial Operations – Businesses are turning to O2C outsourcing to navigate economic uncertainties, enabling cost predictability, improved working capital, and enhanced revenue cycle management.

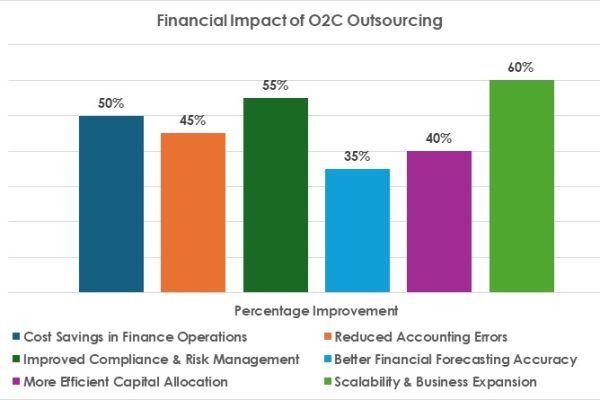

Benefits of Outsourcing O2C Services

1. Improved Cash Flow & Reduced DSO

- Optimized accounts receivable management ensures faster payment collections, reducing DSO and improving liquidity.

2. Cost Savings & Operational Efficiency

- Outsourcing eliminates the need for an in-house accounts receivable team, reducing administrative costs and improving process efficiency.

3. Enhanced Accuracy & Compliance

- Leveraging industry best practices ensures regulatory compliance, minimizing errors in invoice processing, credit management, and collections.

4. Strengthened Customer Relationships

- A well-managed O2C process leads to transparent billing, timely communication, and improved customer satisfaction.

5. Scalability & Business Agility

- Outsourcing provides the flexibility to scale O2C operations based on business needs, ensuring seamless adaptation to market fluctuations.

Why Choose Eximius Ventures for O2C Outsourcing?

- Proven Expertise – Years of experience in Accounts Receivable and O2C outsourcing.

- Tailored Outsourcing Solutions by Eximius – At Eximius Ventures, we offer customized accounting services designed to meet the unique needs of your business, ensuring efficient, cost-effective solutions that grow with you.

- Regulatory Compliance – Ensuring adherence to financial and tax regulations and company policies.

- Dedicated Support Team – Dedicated Project Manager for efficient Accounts Receivable process.

Transform Your O2C Process Today!

Partner with Eximius Ventures to streamline your revenue cycle, reduce DSO, and improve financial performance. Our tailored solutions ensure accuracy, efficiency, and cost savings while allowing you to focus on growing your business.

Management Accounting & Reporting

- Outsourcing management accounting and reporting allows organizations to enhance financial insights, improve compliance, reduce operational costs, and strengthen decision-making capabilities. Here are the key benefits, industry trends, and supporting statistics

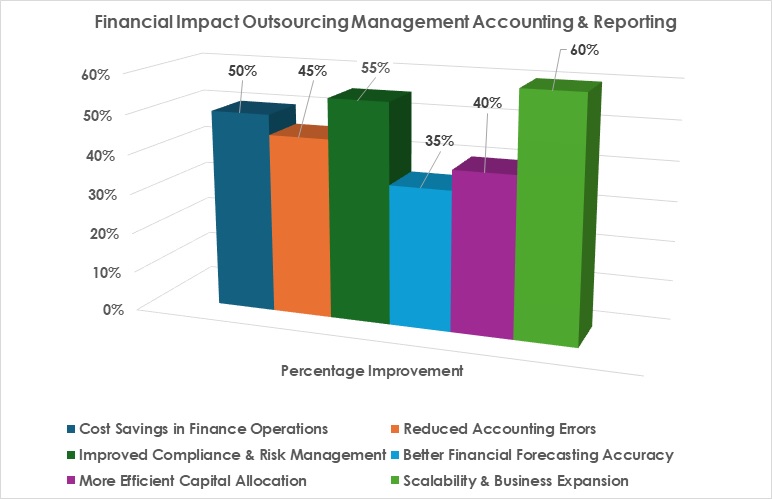

Key Benefits of Outsourcing Management Accounting & Reporting

Cost Reduction & Financial Efficiency

- Lower Operational Costs – Reduces expenses related to in-house financial teams, training, and office infrastructure.

- Predictable Budgeting & Fixed Costs – Outsourcing shifts accounting costs from variable to fixed, improving financial predictability.

- Eliminates the Need for Expensive Financial Tools – Third-party providers handle financial software licensing and updates.

📊 Stat: Businesses outsourcing management accounting save 30-50% on finance department costs. (Deloitte)

Access to Financial Expertise & Strategic Insights

- Specialized Knowledge in Financial Planning & Analysis (FP&A) – Ensures professional guidance on cost control and financial forecasting.

- Industry-Specific Financial Advisory – Outsourced experts provide insights tailored to sector-specific challenges.

- Better Tax & Regulatory Advisory – Ensures accurate financial reporting, reducing tax liabilities and penalties.

📊 Stat: 70% of CFOs believe outsourcing financial reporting provides better access to expertise compared to in-house teams. (EY Global Finance Survey 2024)

Improved Financial Accuracy & Reduced Errors

- Minimized Financial Reporting Errors – Reduces discrepancies in P&L statements and balance sheets.

- Independent Financial Reviews – Third-party accounting firms provide unbiased financial assessments.

- Higher Data Integrity & Transparency – Ensures adherence to GAAP, IFRS, and other global financial standards.

📊 Stat: Companies outsourcing financial reporting reduce accounting errors by 45% and improve compliance rates. (McKinsey & Co.)

Enhanced Compliance & Risk Mitigation

- Stronger Internal Controls & Financial Governance – Reduces fraud risks and unauthorized transactions.

- Regulatory & Tax Compliance – Outsourced teams ensure businesses meet financial reporting and audit requirements.

- Better Audit Preparedness – Professional management accounting firms maintain detailed financial records for easy audits.

📊 Stat: 80% of CFOs say outsourcing financial reporting improved compliance and reduced regulatory fines. (PwC Finance Trends 2024)

Strategic Decision-Making & Business Growth

- Reliable Financial Forecasting & Budgeting – Supports informed business growth decisions.

- Improved Capital Allocation – Optimized financial reporting ensures better resource planning.

- Enhanced Profitability Analysis – Provides deeper insights into cost structures and revenue streams.

📊 Stat: Businesses outsourcing financial analysis achieve 25-35% better financial forecasting accuracy. (Forbes Finance Council)

Scalability & Business Continuity

- Supports Business Expansion – Helps businesses scale operations without hiring additional finance professionals.

- Ensures Financial Stability During Economic Downturns – Professional reporting reduces financial vulnerabilities.

- Adapts to Market Changes – Outsourced financial advisors help navigate economic fluctuations.

📊 Stat: 65% of businesses say outsourcing management accounting has helped them scale operations efficiently. (Harvard Business Review)

Why Partner with Eximius Ventures?

- Proven Expertise – Extensive experience in managing end-to-end P2P and accounts payable solutions without the need for extensive in-house training and skill development.

- Cost-Effective Solutions – Reduction in procurement and processing costs without compromising quality through reduced operational expenses, improved efficiency, and access to specialized expertise.

- Regulatory Compliance – Adherence to global financial standards, procurement best practices, and tax regulations.

- Scalable & Flexible Operations – Custom solutions tailored to your business needs.

- Dedicated Support Team – Dedicated Project Manager ensuring smooth operations and timely vendor communication.

Transform Your Procure-to-Pay Process Today

Partner with Eximius Ventures to streamline your procurement and accounts payable operations. Whether you’re a mid-sized enterprise or a multinational corporation, our outsourcing solutions ensure accuracy, cost savings, and improved financial controls.