Managing Accounts Receivable (O2C) is vital for the financial health of any business. Efficient handling of the Order-to-Cash (O2C) process ensures that companies maintain a steady cash flow.

This process consists of:

- managing customer orders

- recording of invoices

- follow up for payments from customers

However, many businesses face challenges in handling accounts receivable effectively, which can lead to cash flow issues and delayed payments. By outsourcing the O2C process, companies can enhance efficiency, reduce costs, and improve overall customer satisfaction.

What is Accounts Receivable (O2C) Outsourcing?

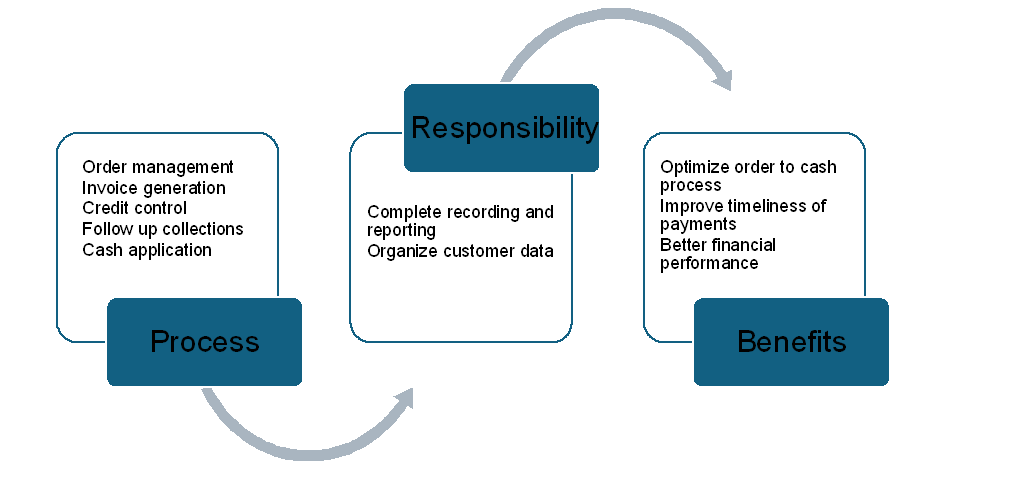

Accounts Receivable (O2C) outsourcing is the delegation of the entire O2C process to an external service provider. This includes order management, invoice generation, credit control, collections, and cash application. The outsourcing partner takes responsibility for ensuring that the company receives payment for goods or services within the agreed-upon time frame.

By outsourcing, businesses can optimize their order-to-cash process. This allows companies to free up internal resources, reduce errors, and improve the timeliness of payments. The O2C outsourcing partner brings expertise in managing the complete cycle, resulting in smoother operations and better financial performance.

Why Outsource Accounts Receivable (O2C)?

One of the main reasons businesses outsource Accounts Receivable (O2C) is to improve cash flow. Late payments can strain a company’s finances and limit its ability to invest in growth. Outsourcing helps streamline the collection process, reducing the time it takes to receive payments. This ensures that businesses have a steady influx of cash to meet their operational needs.

Another reason is to reduce operational costs. Managing accounts receivable in-house requires staff, technology, and resources. By outsourcing, companies can lower these costs while still maintaining efficient operations. The outsourcing partner typically offers a scalable solution, allowing businesses to adjust their services as needed.

Access to Expertise and Advanced Technology

When businesses outsource their Accounts Receivable (O2C) process, they gain access to industry experts who specialize in managing this critical function. These experts use best practices to ensure

- timely collections

- accurate invoicing

- effective credit management.

The outsourced team is well-versed in handling complex situations, such as managing high-volume accounts or dealing with delinquent customers.

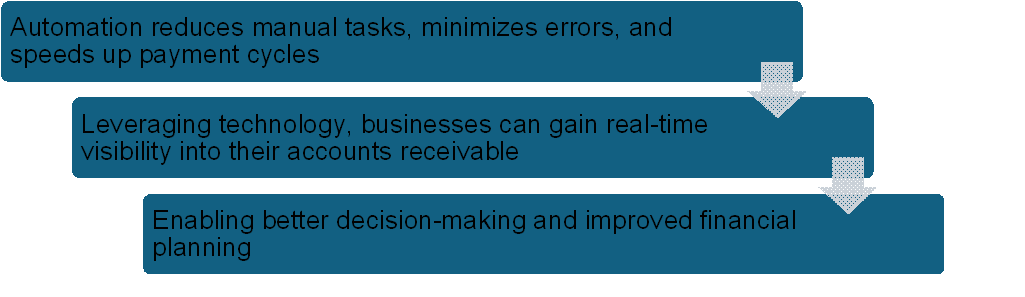

Additionally, outsourcing providers often use advanced technology to automate and optimize the O2C process.

Focus on Core Business Activities

One of the biggest advantages of outsourcing the Accounts Receivable (O2C) process is that it allows businesses to focus on their core activities. Handling the O2C process internally can be time-consuming and distract from other critical areas of the business, such as product development and customer service. By outsourcing, companies can redirect their attention to growth initiatives.

When the accounts receivable process is handled by experts, the internal team can focus on strategic activities that drive revenue. This leads to better customer experiences, stronger product offerings, and increased competitiveness in the market.

Improved Customer Relationships

Outsourcing the Accounts Receivable (O2C) process can also enhance customer relationships. A well-managed O2C process ensures that invoices are accurate and delivered on time, reducing the likelihood of disputes. In the event of a payment issue, the outsourcing provider can handle collections professionally, ensuring that customer relationships remain intact.

A smooth O2C process leads to higher customer satisfaction. Customers appreciate timely and accurate invoicing, which reflects positively on the company’s reputation. Additionally, outsourcing providers often use customer-friendly approaches to collections, which helps maintain strong relationships with clients even when payments are overdue.

Scalability and Flexibility

As businesses grow, their accounts receivable process becomes more complex. Managing a growing volume of orders and payments can overwhelm an in-house team. Outsourcing the Accounts Receivable (O2C) process offers flexibility and scalability. The outsourcing partner can adjust their services to meet the changing needs of the business, ensuring that the O2C process runs smoothly regardless of volume.

This scalability is particularly beneficial for companies experiencing seasonal fluctuations in demand. During peak periods, the outsourcing provider can handle increased order volumes, ensuring that collections remain on track. During slower periods, the business can scale back its outsourcing requirements, keeping costs in check.

Reduced Risk and Compliance

Outsourcing the Accounts Receivable (O2C) process helps businesses reduce risk. Accounts receivable management involves dealing with sensitive financial information, and outsourcing providers implement robust security measures to protect this data. This includes encryption, secure payment methods, and compliance with industry regulations.

Additionally, outsourcing providers stay up to date with the latest financial regulations and standards. This helps businesses ensure compliance with local and international accounting rules, reducing the risk of fines or legal issues.

Choosing the Right Outsourcing Partner

When considering Accounts Receivable (O2C) outsourcing, it’s essential to select the right partner. Not all outsourcing providers are created equal, so businesses must carefully evaluate potential partners. Factors to consider include:

- experience

- technology

- customer service

Experience is critical because it ensures that the provider understands the complexities of the O2C process. Companies should look for a partner with a proven track record of managing accounts receivable for businesses of similar size and industry. This ensures that the provider can handle the specific challenges and requirements of the company.

Technology is another important factor. The best outsourcing providers use advanced software to automate invoicing, collections, and cash applications. Businesses should ensure that the provider they choose has the right tools to enhance efficiency and accuracy.

Finally, customer service and pricing are key considerations. The outsourcing partner should offer excellent support and be responsive to the business’s needs. Additionally, companies should ensure that the pricing model aligns with their budget and financial goals.

Conclusion

Outsourcing Accounts Receivable (O2C) offers numerous benefits to businesses of all sizes.

Additionally, outsourcing provides scalability, flexibility, and access to advanced technology, enabling businesses to manage their accounts receivable efficiently.

In a competitive business landscape, it’s essential for companies to focus on their core activities. By outsourcing the O2C process, businesses can redirect their attention to growth initiatives while ensuring that their financial operations run smoothly. With the right outsourcing partner, companies can achieve better financial performance, reduce risk, and maintain strong customer relationships.

Businesses looking to improve their cash flow and streamline operations should consider Accounts Receivable (O2C) outsourcing. It’s a strategic move that can lead to long-term success and growth.