In today’s fast-paced business world, companies are constantly seeking ways to improve their efficiency. Accounts payable outsourcing is one such method that has gained popularity in recent years. Businesses, both large and small, are discovering the many benefits of outsourcing their accounts payable processes. By doing so, they can focus more on their core operations, reduce costs, and improve the overall efficiency of their financial management.

Table of Contents

ToggleWhat is Accounts Payable Outsourcing?

Accounts payable outsourcing is the process of hiring an external service provider to manage a company’s accounts payable tasks. This includes:

- Purchase order matching

- Processing of invoices

- Making payments to the vendor

- Achieving records and reporting

- Managing vendor relationships

The outsourcing partner takes over these tasks, ensuring that all accounts payable functions are handled smoothly and on time.

Why Outsource Accounts Payable?

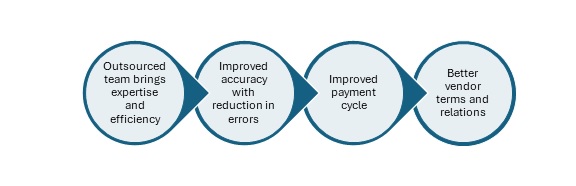

There are several reasons why businesses opt for accounts payable outsourcing. One of the most significant benefits is cost savings. Managing accounts payable in-house can be expensive, especially for small to medium-sized businesses. Hiring staff, investing in software, and maintaining proper infrastructure all come at a cost. By outsourcing, companies can reduce these expenses and only pay for the services they need.

Many companies choose accounts payable outsourcing because it allows them to streamline their financial operations. Instead of dedicating time and resources to these tasks, they can focus on growing their business.

Another reason is improved accuracy. Mistakes in accounts payable can lead to late payments, which may damage relationships with vendors. By outsourcing, companies can rely on experts who specialize in handling these tasks. This reduces the likelihood of errors and ensures that all payments are made on time.

Outsourcing also provides access to the latest technology. Many accounts payable outsourcing providers use advanced tools to automate processes. This not only speeds up payment cycles but also provides real-time insights into a company’s financial health. Automation reduces manual work, lowers the risk of human error, and increases overall efficiency.

Increased Focus on Core Business Activities

When companies handle their accounts payable processes internally, they often divert resources from other critical business functions. By choosing accounts payable outsourcing, businesses can redirect their attention to activities that drive growth such as

- Product development

- Marketing

- Customer service.

Outsourcing accounts payable tasks allows the internal team to focus on strategic activities rather than getting bogged down by administrative tasks. This shift in focus can lead to innovation, better customer experiences, and a stronger market position.

Scalability and Flexibility

Another key benefit of accounts payable outsourcing is scalability. As businesses grow, their financial processes become more complex. Managing a growing volume of invoices and payments can become overwhelming for an in-house team. Outsourcing provides the flexibility to scale operations up or down, depending on the company’s needs.

Whether a company experiences seasonal spikes or long-term growth, outsourcing partners can adjust their services to match the demand. This ensures that accounts payable tasks are always handled efficiently, even during periods of high activity.

Improved Compliance and Risk Management

Accounts payable outsourcing providers are experts in financial regulations and compliance. They stay updated with the latest changes in tax laws, accounting standards, and payment regulations. This expertise helps businesses avoid costly mistakes and ensures that they remain compliant with all legal requirements.

Additionally, outsourcing accounts payable reduces the risk of fraud. Many providers implement strict security measures, such as dual authorization and encryption, to protect sensitive financial data. This added layer of security gives businesses peace of mind, knowing that their financial information is safe.

Choosing the Right Outsourcing Partner

When considering accounts payable outsourcing, it’s essential to choose the right provider. Not all outsourcing companies offer the same level of service, so businesses must carefully evaluate their options. Some key factors to consider includes:

- Provider’s experience,

- Technology used

- Pricing structure provided

Experience is crucial because it ensures that the provider has a deep understanding of the accounts payable process. Companies should look for a provider that has worked with businesses of similar size and industry. This ensures that the outsourcing partner can handle the specific needs and challenges of the company.

Technology is another important factor. The best accounts payable outsourcing providers use advanced software to automate processes and provide real-time reporting. Companies should ensure that the provider they choose has the right tools to enhance efficiency and accuracy.

Finally, pricing is a consideration. While accounts payable outsourcing can save money in the long run, businesses should ensure that they are getting good value for their investment. Providers typically offer different pricing models, such as per transaction or fixed monthly fees. It’s important to choose a model that aligns with the company’s budget and financial goals.

Conclusion

Accounts payable outsourcing offers numerous benefits for businesses of all sizes. By outsourcing these tasks, companies can reduce costs, improve accuracy, and focus on their core business activities. Additionally, outsourcing provides scalability, flexibility, and improved compliance, helping businesses manage their financial processes more efficiently.

As businesses continue to grow and evolve, accounts payable outsourcing will remain a valuable tool for streamlining operations and enhancing overall financial management. With the right outsourcing partner, companies can ensure that their accounts payable tasks are handled with expertise and precision, allowing them to focus on what truly matters: driving growth and success.

In today’s competitive landscape, businesses must look for innovative ways to manage their operations efficiently. By embracing accounts payable outsourcing, companies can stay ahead of the curve and continue to thrive. Whether it’s a small startup or a large enterprise, outsourcing accounts payable processes can lead to significant improvements in efficiency and cost savings.