Audit preparation is a crucial process that ensures a business complies with regulatory standards. Many organizations turn to accounts payable outsourcing to streamline audit preparation. This approach minimizes errors and enhances the accuracy of financial records, making audits seamless and efficient.

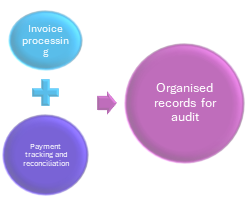

Outsourcing accounts payable plays a significant role in maintaining accurate and transparent financial documentation. Professional providers handle invoice processing, payment tracking, and reconciliation efficiently. This ensures businesses have organized records that auditors can review easily.

Outsourcing accounts payable plays a significant role in maintaining accurate and transparent financial documentation. Professional providers handle invoice processing, payment tracking, and reconciliation efficiently. This ensures businesses have organized records that auditors can review easily.

Regulatory compliance often requires adherence to strict standards and deadlines. Outsourced professionals are experts in meeting these requirements.

· Experts reduce the risk of penalties

· Keeps businesses aligned with legal obligations

Automation tools used in accounts payable outsourcing improve the efficiency of audit preparation. These tools generate detailed transaction reports with minimal manual intervention. Automated processes ensure that all financial data is up-to-date and easily accessible.

Small and medium-sized businesses benefit significantly from outsourcing audit preparation tasks. Limited resources can make compliance management challenging for in-house teams. Outsourcing provides affordable access to specialized expertise, ensuring regulatory adherence.

Timely and accurate reconciliation of accounts is essential for audits. Outsourcing providers ensure that all discrepancies in accounts payable are resolved promptly. This proactive approach reduces the chances of audit-related issues.

Fraud detection is another critical benefit of accounts payable outsourcing. Service providers implement advanced monitoring techniques to identify suspicious transactions. This safeguards businesses from fraudulent activities and strengthens their financial integrity.

Compliance with tax laws and financial reporting standards is simplified with outsourcing. Providers stay updated on changing regulations and adjust processes accordingly. This expertise ensures that businesses remain compliant without additional effort.

Compliance with tax laws and financial reporting standards is simplified with outsourcing. Providers stay updated on changing regulations and adjust processes accordingly. This expertise ensures that businesses remain compliant without additional effort.

Outsourcing accounts payable reduces administrative burdens for internal teams. Employees can focus on strategic tasks instead of preparing financial records for audits. This efficiency enhances productivity and supports better resource allocation.

Real-time data access is a key advantage of accounts payable outsourcing. Providers use cloud-based platforms to store and manage financial records securely. Auditors can access these records instantly, speeding up the audit process.

Transparency in accounts payable processes is vital for successful audits. Outsourcing ensures that all transactions are documented clearly and systematically. This level of transparency builds trust with stakeholders and regulatory bodies.

Cost savings is a significant benefit of outsourcing accounts payable for audit preparation. Businesses save on staffing and infrastructure costs associated with in-house compliance teams. These savings can be reinvested into growth initiatives.

Global businesses face unique challenges in managing compliance across multiple jurisdictions. Accounts payable outsourcing providers specialize in handling region-specific regulations. This expertise ensures consistency and compliance on a global scale.

The expertise of outsourced professionals enhances the quality of audit preparation. They analyze financial data meticulously, ensuring all records meet audit standards. This meticulous approach reduces the risk of discrepancies during the audit.

Outsourcing accounts payable fosters better vendor relationships, which can positively impact audits. Accurate and timely payments ensure smooth vendor interactions. Strong vendor partnerships reflect positively during compliance reviews.

Cloud-based solutions used in accounts payable outsourcing provide enhanced data security. Providers implement robust encryption and access controls to protect sensitive information. This security reassures businesses and auditors alike during the audit process.

Cloud-based solutions used in accounts payable outsourcing provide enhanced data security. Providers implement robust encryption and access controls to protect sensitive information. This security reassures businesses and auditors alike during the audit process.

Outsourcing providers offer customizable solutions tailored to a company’s needs. Businesses can scale services up or down based on their compliance requirements. This flexibility ensures that audit preparation aligns with evolving business demands.

Startups and growing businesses benefit from the affordability of outsourcing. Hiring full-time compliance experts can be expensive for new ventures. Outsourcing offers access to professional services without straining budgets.

Timely and accurate financial reporting is essential for audit readiness. Accounts payable outsourcing ensures that all

· Reports are prepared and submitted on schedule.

· Simplifies the audit process.

· Boosts confidence in compliance practices.

In conclusion, accounts payable outsourcing is an effective solution for ensuring regulatory compliance and simplifying audit preparation. It saves time, reduces costs, and enhances the accuracy of financial records, making it an indispensable strategy for businesses. This approach enables organizations to focus on growth while maintaining trust with stakeholders and regulators.